Roth ira withdrawal tax calculator

Call 866-855-5635 or open a Schwab IRA today. First say that youre 55 years old and opening a Roth IRA for the first time.

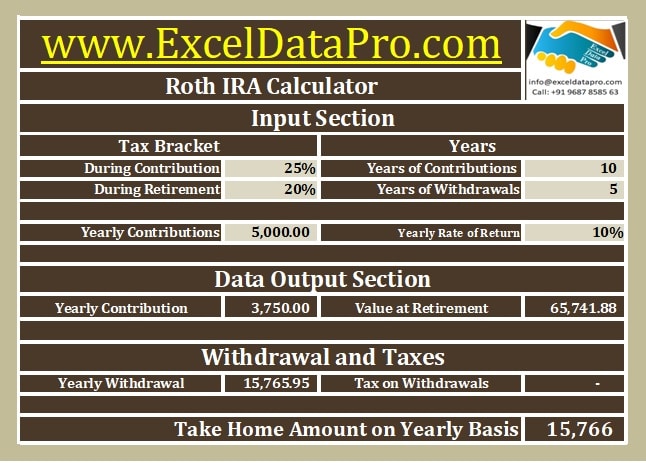

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Open an IRA Explore Roth vs.

. Here are some examples of how Roth IRA distributions may be taxable. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Distributions from a Roth IRA may be subject to income taxes and in some cases the 10 penalty.

Roth IRA Taxable Distribution Examples. You can adjust that contribution down if you plan to. Reviews Trusted by Over 20000000.

Traditional IRA Calculator can help you decide. In the Roth version of IRAs and 401 k plans contributions are made after taxes are paid. Traditional or Rollover Your 401k Today.

Money deposited in a traditional IRA is treated differently from money in a Roth. The calculator will estimate the monthly payout from your Roth IRA in retirement. 1 2024 to withdraw your Roth IRA earnings tax.

It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are tax-free in retirement. Traditional or Rollover Your 401k Today. Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement.

Here are a few common scenarios to consider. Your earnings from those contributions may be subject to income tax or penalties in. Choosing between a Roth vs.

The calculator assumes that your marginal tax rate is 25. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. For example if you contributed to your Roth IRA in early April 2020 but designated it for the 2019 tax year youll only have to wait until Jan.

Find a Dedicated Financial Advisor Now. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. State income tax rate.

That is it will show which amounts will be subject to ordinary income tax andor 10 penalty Please note that it assumes that you are the original owner of the Roth IRA ie you did not inherit it from somebody else. To calculate the penalty on an early withdrawal simply multiply the taxable distribution amount by 10. Do Your Investments Align with Your Goals.

If you are at least age 59 ½ but have not met the five-year requirement distributions of earnings from the account will be taxed but not subject to the 10 penalty. Withdrawals are subject to income tax and prior to age 59-12 may also be subject to a 10 additional tax penalty. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn.

Open an IRA Explore Roth vs. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset growth tax consequences and penalties based on information you specify. Second you must be at least 59½.

At retirement also after age 59 12 contributions and earnings can be withdrawn tax-free. 2 There are phaseout amounts based. You can withdraw your original Roth IRA contributions for any reason and at any time without penalty or tax.

If its a traditional IRA SEP IRA Simple IRA or SARSEP IRA you will owe taxes at your current tax rate on the. Explore Your Choices For Your IRA. Roth IRA Contributions and Phaseouts The contribution limits for 2021 and 2022 are set at 6000.

Compare 2022s Best Gold IRAs from Top Providers. Traditional IRA depends on your income level and financial goals. The Roth IRA Conversion Calculator is intended to serve as an educational tool and should not be the primary basis of your investment financial or tax planning decisions.

You can put in an additional 1000 if you are age 50 or older. This tool is intended to show the tax treatment of distributions from a Roth IRA. For some investors this could prove to.

Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Get Up To 600 When Funding A New IRA. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience.

First you must have held a Roth IRA account for at least five years a clock that starts ticking at the beginning of the year of your first contribution. Is a Roth IRA retirement account tax-free. 0 6 13 20 Withdrawing 1000 leaves you with 610 after taxes and penalties Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan.

1 A distribution from a Roth IRA is tax-free and penalty-free provided that the 5-year aging requirement has been satisfied and at least one of the following conditions. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. Explore Choices For Your IRA Now.

For example an early distribution of 10000 would incur a 1000 tax penalty and it would. Ad Get Up To 600 When Funding A New IRA.

Ira Withdrawal Calculator Online 54 Off Www Alforja Cat

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Roth Ira Contribution

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Best Roth Ira Calculators

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Roth Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Free Traditional Ira Calculator In Excel

Roth Ira Conversion Calculator Excel

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Roth Ira Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Excel Template For Free

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator